Stocks Ending the Week on a Positive Note

Is it a correction or wave after the correction? After the tumbling of stock market of two weeks finally investors are having a breath of sigh with stock market set to close on a positive note. Was the downside the correction of market or is this the correction. Wall Street experts are taking the odds that it started with the news from Labor department reported the sharp increase in earnings leading to the expectation of increased interest rates and inflation. Some also believes that the downside started after investors started pulling back after the expected interest rates hike indicated by Federal Reserve early February. Another theory is Information about changes in fundamentals drove stock and bond returns. The decline in prices of stocks of pharmaceutical and health care companies on Tuesday followed by new information about health care plans by plans by Amazon, Berkshire-Hathaway, and JPMorgan-Chase an example. However, there was no specific information about changes in fundamentals, although we can infer such information in an increase in employment, reviving fears of inflation and higher wages (good for workers but not always for companies),Or it might be the effect of "sentiment" in the form of fear, perhaps justified or perhaps excessive. Nevertheless here's where we are, The market is back in its positive streak as investors age gaining back the confidence in the highly volatile market.

Indexes*-:

| S&P 500 | 2750.96 | +19.76 | 0.72% |

|---|---|---|---|

| DOW | 25401.81 | +201.44 | 0.80% |

| NASDAQ | 7298.06 | +41.63 | 0.57% |

*Index reflect mid-day prices on Feb 16, 2018 and changes from previous trading day.

For the S&P 500 week-:

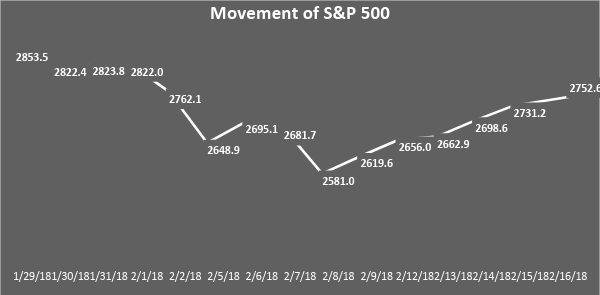

S&P 500 gained 3.6% this week with an increase of 96 points on the index balancing the 5% decline in previous two weeks.

All 11 sectors were up this week, as all 11 were down last week.

As you can see from the above graph it S&P 500 is still not back to the level it started the year with still Wall Street is optimistic about the future considering the economic growth and waiting to see the impacts of tax reform.

Top 5 Winners of the day (02/16/2018)

| Symbol | Name | Price (Intraday) | Change | %Change | Volume |

|---|---|---|---|---|---|

| MULE* | MuleSoft Inc. | 30.7 | +4.57 | +17.41% | 10.048M |

| BL | Blackline, Inc. | 39 | +4.29 | +12.41% | 1.014M |

| X | United States Steel Corporation | 43.1 | +3.99 | +10.36% | 23.545M |

| IBP | Installed Building Products, Inc. | 69.65 | +5.65 | +8.83% | 246,920 |

| ALKS | Alkermes plc. | 68.75 | +4.87 | +7.62% | 1.833M |

*MuleSoft (NYSE:MULE) provides integration software for connecting applications, data and devices. The stock's gain follows MuleSoft's fourth-quarter earnings release early am on Friday. Optimism toward the stock on Friday likely reflects the company's higher-than-expected fourth-quarter revenue, as well management's promising outlook for 2018.

Top 5 Decliners of the day (02/16/2018)

| Symbol | Name | Price (Intraday) | Change | %Change | Volume |

|---|---|---|---|---|---|

| ANET | Arista Networks, Inc. | 255.08 | -53.02 | -17.34% | 6.972M |

| LFIN | Longfin Corp. | 37.66 | -4.57 | -10.83% | 177,319 |

| AUY | Yamana Gold Inc. | 3.09 | -0.37 | -10.75% | 18.698M |

| VFC | V.F. Corporation | 76.22 | -7.74 | -9.16% | 6.188M |

| MDRX | Allscripts Healthcare Solutions, Inc. | 13.64 | -1.20 | -8.19% | 7.042M |

What's ahead?

Does this means this kind of fluctuations are expected in future? Absolutely!

| "Nothing broke technically, but you still had rapid rollercoaster moves, which are unsettling," Saluzzi, of Themis Trading, said. "That's not going to change. Anytime there's stress in the market, you're going to see moves like that." |

|---|

Any disruption in the sentiments of the investors causes these fluctuations and investors are finding it difficult to believe in the market where they can lose hundreds of points in seconds. Charles Schwab earlier last week suggested investors not to panic and hold on for 2 investment days before they lose the confidence because the variability is high at the moment.

This is because the market has now reached its maturity phase and any information shakes the efficient market hypothesis and behavioral aspect of investors drive the market. The strong pain from past 2 weeks are healing but still the coming week will be crucial to see the investors' confidence as few big earnings are expected.